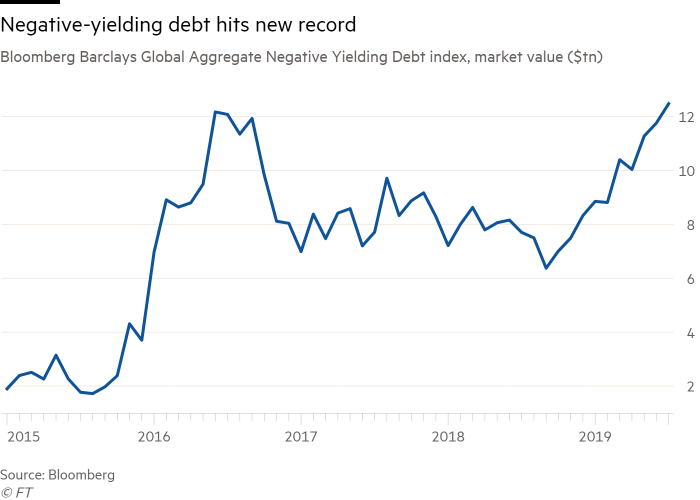

If you are an investor, the chart above should be on your radar. It’s a chart representing the dollar value of negative yielding debt globally. The chart, as of June 20th 2019, just hit a new high of 12.5 Trillion dollars. That’s Trillion with a “T”. A traditional bond agrees to pay you back your principal plus an annual interest amount each year. With a negative yielding bond you would still be promised a return of your principal, but now you have to pay the issuer to own the bond. Essentially, when you buy a negative yielding bond you are GUARANTEED to lose money if you hold the bond to maturity.

That sounds crazy! Why are there so many negative yielding bonds out there?

Certainly, quantitative easing by global central banks (US, European Union and Japan) is partly to blame. To spark inflation in an effort to stimulate their respective economies, global central banks have been buying up their own government bonds. In theory, this should increase the money supply and force the previous holder of the bond to reinvest the proceeds in riskier assets like junk bonds or stocks. This buying has significantly reduced the supply of high quality government bonds, but has not dented demand. Low supply and high demand means global governments are able to issue these bonds at negative yields.

Where is the demand for these bonds coming from?

The rise of “indexing” may be to blame. Most people are familiar with the way stock indexes work. Stock indexes, like the S&P 500, buy every stock in the index weighted by market capitalization. The end result for investors in the index is that you end up owning the most of largest companies in the index, and the least of the smaller companies.

Bond indexes are very similar, but the indexes are weighted by the bond issues with the highest dollar amount of debt outstanding. As an investor in a bond index, you end up owning the most bonds of companies and countries with the highest amounts of debt. Those countries with the highest amount of debt outstanding are the same countries that have engaged in the quantitative easing mentioned above. Think Germany, France, Italy, and Japan. As investor pour more and more money into global bond indexes, those fund flows purchase these bonds at higher prices which in turn lowers the yield into negative territory even more.

Most bond investors are looking for the safe return of their principal investment plus an interest amount greater than the rate of inflation. Bonds with a negative yield GUARANTEE that you will lose purchasing power to inflation for the stated period of the bond.

So what is an investor to do?

Staying far away from global bond indexes could be a good place start. They are a common investment option in the “target date” mutual funds that have taken over the 401(k) retirement plan space. The alternative would be to find an “actively managed” bond fund in place of the index. Most active bond fund managers understand that investors are looking for safety, plus a rate of return greater than inflation so as to protect purchasing power. Instead of blindly purchasing bonds of the most indebted companies and countries, an active bond fund manager will purchase only the bonds that have a very high probability of providing a return greater than the rate of inflation.

*The above article is informational in nature only and is not a recommendation to buy or sell securities. All information is gathered from sources believed to be reliable, but neither Charles Brown nor Ausdal Financial Partners, Inc guarantees the accuracy of the information. All investments carry a degree of risk. Individuals should consult with their tax and investment professionals before making changes to their investment portfolios.

**Securities and Advisory Services offered through Ausdal Financial Partners, Inc., an SEC registered investment adviser, member FINRA & SIPC. 5187 Utica Ridge Rd., Davenport IA 52807, 563-326-2064, www.ausdal.com. Sub-advisory services offered through M. Brown Financial Advisors, a registered investment adviser with the state of Illinois. M. Brown Financial Advisors is located at 2728 Forgue Drive, Suite 100, Naperville, IL 60564, 630-637-8600. M. Brown Financial Advisors and Ausdal Financial Partners are unaffiliated entities and only transact business in states where they are properly registered, or are excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission or any state regulators. Ausdal Financial Partners, Inc. does not accept buy, sell or cancel orders by email, or any instructions by e‐mail that would require your signature. Information contained in this communication is not considered an official record of your account and does not supersede normal trade confirmations or statements. Any information provided has been prepared from sources believed to be reliable but does not represent all available data necessary for making investment decisions and is for informational purposes only.

Pingback: Three Key Investing Charts for 2020 – The Naperville Financial Planner